Top 8 Budget Planning Apps of 2025 Best Tools to Manage Your Money

Why Budgeting Tools Are Essential for Financial Planning in 2025

The foundation of personal financial success is still budgeting, particularly in 2025 as interest rates, inflation, and digital money all continue to change. The difference between thriving and just surviving can be determined by the budgeting tool you choose. A strong financial app can turn your financial goals into tangible outcomes, whether you’re managing debt, saving for emergencies, or expanding your high-yield savings.

In this thorough analysis, we look at the top budgeting resources for 2025. These tools were assessed according to their feature set, price, user experience, and applicability for the most recent financial trends. Every platform has distinct advantages suited to various requirements, ranging from smooth syncing with your financial accounts to automated tracking and real-time budget planning.

Let’s examine the best tools available for customers to manage their money in 2025. There is a perfect solution here for everyone, regardless of whether you are new to budgeting or want to upgrade

1. YNAB (You Need A Budget)

Cost: $14.99/month or $99 annually

Platform: Web, iOS, and Android

Key features:

- A system of zero-based budgeting

- Device synchronizing in real time

- Comprehensive reporting and analysis of trends

- Monitoring Emergency Funds and Debt Management Objectives

- Integration of banks for automated imports

Pros:

- promotes proactive budgeting

- provides educational financial literacy materials.

- Ideal for regular users who want to end the cycle of paycheck-to- paycheck

Cons:

- Beginners’ learning curve is steeper

- No free version is available.

Best For:

- Users seeking a highly structured approach for handling their monthly spending plans

- People focused on creating sound saving habits and financial resolutions.

2. Mint by Intuit (Now part of Credit Karma)

Price: Free (with ads)

Platform: iOS, Android, Web

Key Features:

- All-in-one financial dashboard

- Credit score monitoring

- Bill tracking and alerts

- Budget recommendations based on spending patterns

Pros:

- Completely free to use

- Easy setup with automatic account syncing

- Good for financial beginners

Cons:

- Ads can be intrusive

- Limited customization in budget categories

Best For:

- Beginners in budget planning

- Users who want to monitor spending and credit in one place

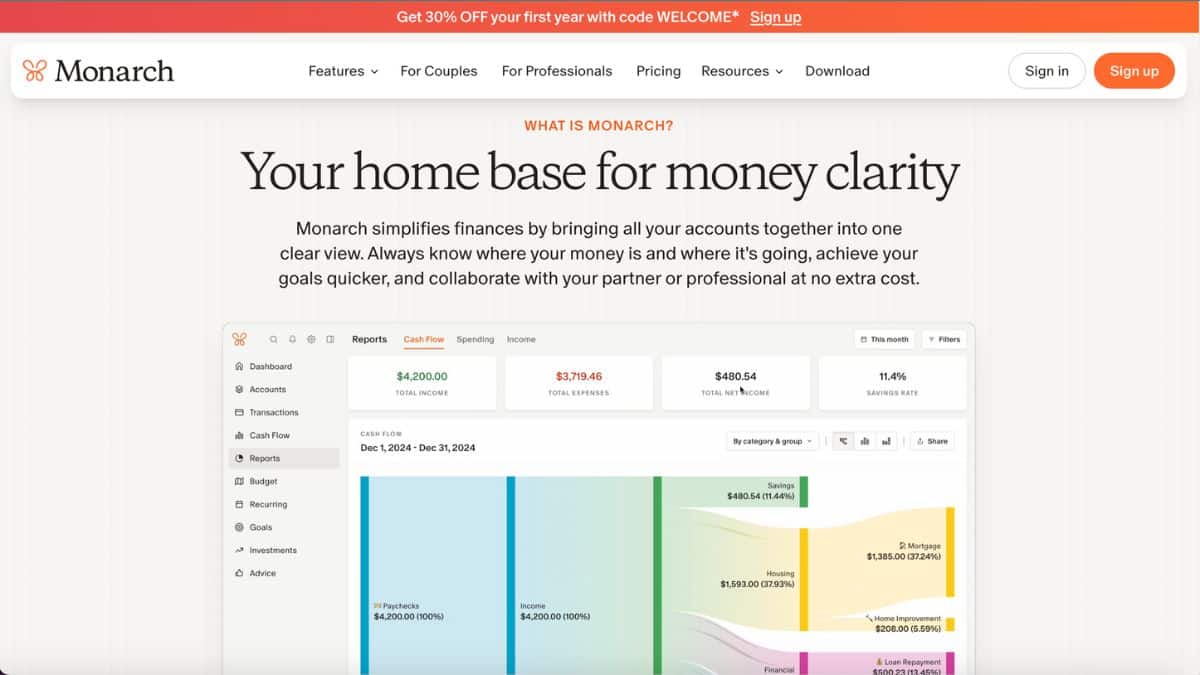

3. Monarch Money

Price: $14.99/month or $99/year

Platform: iOS, Android, Web

Key Features:

- Customizable financial goals

- Shared household budgets

- Net worth tracking

- High-Yield Savings account integration

Pros:

- Ideal for couples and families

- Great visual dashboards

- Allows collaboration with financial advisors

Cons:

- No free version

- Bank sync issues reported by some users

Best For:

- Families and couples aiming for unified financial management

- Long-term financial planning

4. PocketGuard

Price: Free basic plan, $7.99/month for PocketGuard Plus

Platform: iOS, Android, Web

Key Features:

- “In My Pocket” budgeting feature

- Automatic transaction categorization

- Bill negotiation and subscription cancellation

- Emergency Funds and savings goals

Pros:

- Simple interface with visual insights

- Helps reduce unnecessary spending

- Encourages saving without complexity

Cons:

- Limited customization in the free version

- Some bank connectivity limitations

Best For:

- Individuals seeking intuitive, low-maintenance budget planning

- Users focusing on saving strategies

Read next: How to Build an Emergency Fund from Scratch

5. Goodbudget

Price: Free basic plan, $8/month or $70/year for Plus

Platform: iOS, Android, Web

Key Features:

- Envelope budgeting system

- Manual transaction entry (no bank sync)

- Expense tracking and reporting

- Syncs across multiple devices

Pros:

- Encourages mindful spending

- Excellent for cash-based budgeters

- Strong for Debt Management through envelope discipline

Cons:

- No automatic bank integration

- Not ideal for users wanting automation

Best For:

- Users who prefer manual budgeting

- Those focused on debt payoff and hands-on financial tracking

6. Empower (formerly Personal Capital)

Price: Free financial dashboard; Wealth management services start at 0.89% AUM

Platform: iOS, Android, Web

Key Features:

- Comprehensive financial planning tools

- Investment tracking and retirement calculators

- Real-time net worth tracking

- Budget Planning and High-Yield Savings suggestions

Pros:

- Strong for high-net-worth individuals

- Consolidates investment and budgeting tools

- Visual, data-rich reporting

Cons:

- Budgeting features less detailed than competitors

- Geared toward users with investable assets

Best For:

- Investors seeking all-in-one financial tools

- Users with complex financial portfolios

7. Zeta

Price: Free

Platform: iOS, Android, Web

Key Features:

- Designed for couples and families

- Joint account management

- Personalized insights and reminders

- Financial goal tracking (Emergency Funds, Home Buying, etc.)

Pros:

- Tailored to shared finances

- Clear communication tools for partners

- Free with no ads

Cons:

- Limited features for single users

- Lacks investment tools

Best For:

- Couples sharing financial responsibilities

- Users focusing on relationship-based budgeting

8. Quicken Simplifi

Price: $2.99/month (billed annually)

Platform: iOS, Android, Web

Key Features:

- Customizable spending plans

- Watchlists for recurring expenses

- Forecasting and cash flow planning

- Integration with savings goals

Pros:

- Clean, modern UI

- Comprehensive forecasting tools

- Strong mobile performance

Cons:

- No free version

- Requires time to fully customize

Best For:

- Tech-savvy users who want detailed insights

- Budgeters focused on long-term projections

Comparison Table Overview

| Tool | Price | Best For | Automation | Debt Management | Savings Goals | Platform |

| YNAB | $14.99/month | Structured budgeters | Yes | Yes | Yes | iOS/Android/Web |

| As | Free | Beginners | Yes | Basic | Basic | iOS/Android/Web |

| Monarch Money | $14.99/month | Families & couples | Yes | Yes | Yes | iOS/Android/Web |

| PocketGuard | Free/$7.99 | Simplicity-focused users | Yes | Basic | Yes | iOS/Android/Web |

| Goodbudget | Free/$8 | Manual budgeters | No | Yes | Yes | iOS/Android/Web |

| Empower | Free | Investors | Yes | No | Yes | iOS/Android/Web |

| Zeta | Free | Couples | Yes | Yes | Yes | iOS/Android/Web |

| Simplifi | $3.99/month | Forecast-focused planners | Yes | Basic | Yes | iOS/Android/Web |

Selecting the Best Budgeting App for Your Financial Goals

Choosing the best budgeting tool will depend on a number of factors, including your financial objectives, preferred budgeting method, and the intricacy of your finances. Every tool has a different value offering, ranging from manual planners like Goodbudget to automatic systems like YNAB and Simplifi. Whether your goal is to maximize your high-yield savings, prioritize debt management, or create emergency funds, combining your financial practices with the appropriate tools speeds up your financial resolutions.

Are you ready to take care of your money? Try out one of these top budgeting apps right now to make your most financially independent year to date. If you make prudent financial choices today, you’ll be happy you did.

FAQS

What is the easiest budgeting app in 2025?

Mint is a good pick for starters. It’s free, links to banks fast, and shows easy spending tips to manage money well.

Which budgeting app is best for debt?

YNAB and Goodbudget are best for paying off debt. They help plan, track progress, and keep you on track using simple systems.

Are there any budgeting tools for couples or families?

Yes, try Monarch Money or Zeta. They help couples or families with shared budgets, goals, and full view of finances.

Can budgeting apps help save for an emergency fund?

Sure. Apps like PocketGuard, YNAB, and Simplifi let you set savings goals, like emergency funds. They track progress and suggest monthly savings.

What’s the best free budgeting app in 2025?

Mint and Zeta are great free picks. They offer key features like tracking expenses, setting goals, and syncing accounts, all at no cost.

How do budgeting apps link to my bank? Is it safe?

Yes, most apps use strong security and trusted services like Plaid to link your accounts. Pick apps with good privacy rules and proven safety.

Can budgeting apps track investments, too?

Yes, apps like Empower track investments and net worth. They help you manage all finances in one place.